internet tax freedom act texas

105277 text PDF on October 21 1998 by President Bill Clinton in an effort to promote and preserve the commercial educational and informational potential of the Internet. Internet access fees are currently subject to state and local sales tax in Hawaii New Mexico Ohio South Dakota Texas and Wisconsin.

What Is The Internet Tax Freedom Act Howstuffworks

Internet Tax Freedom Act ITFA The ITFA was enacted in 1998 as a 3-year moratorium preventing governments at the local state and federal levels from imposing transaction taxes on internet access one of the exceptions being that states already taxing internet access as of October 1 1998 were grandfathered in.

. Federal law included a grandfather clause for those state and local governments including Texas who imposed a tax on internet services prior to October 1 1998. Permanent Internet Tax Freedom Act Amends the Internet Tax Freedom Act to make permanent the ban on state and local taxation of Internet access and on multiple or. This change correlates with legislation enacted in 2016 that permanently extended the Internet Tax Freedom Act.

While there was still anticipation that the Permanent Internet Tax Freedom Act would be included in one of the nexus extension clauses that did not happen. The Internet Tax Freedom Act which was first passed in 1998 prohibited taxes on internet access. The legislation established an end date of June 30 2020 for seven states that imposed a tax on internet access at the time.

On December 15 2015. Internet Tax Freedom Act ITFA The ITFA was enacted in 1998 as a 3-year moratorium preventing governments at the local state and federal levels from imposing transaction taxes on internet access one of the exceptions being that states already taxing internet access as of October 1. 235 the Act of Permanent Internet Tax Freedom.

Hawaii New Mexico North Dakota Ohio South Dakota. Little-noticed changes to the Internet Tax Freedom Act made by Congress in 2007 expanding the scope of services preempted from state taxation are at issue in Apple Inc. The Internet Tax Freedom Act ITFA.

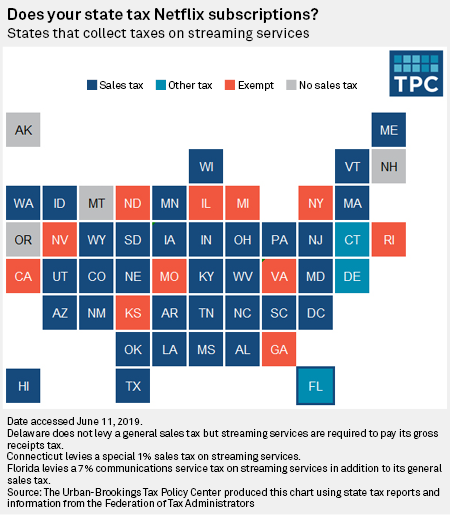

1054 TAX FREEDOM ACT July 17 199 Serial No. On July 1 sales taxes levied on internet access in six statesHawaii New Mexico Ohio South Dakota Texas and Wisconsinwill become illegal under the provisions of the Permanent Internet Tax Freedom Act PITFA. Congress extended the ITFA.

The Internet Tax Freedom Act ITFA. Federal law included a grandfather clause for those state and local governments including Texas who imposed a tax on internet services prior to October 1 1998. Beginning July 1 2020 Texas will no longer impose sales tax on separately stated internet access charges due to the Internet Tax Freedom Act ITFA of 2016.

Texas collected tax on internet access prior to the enactment of ITFA under the. At the time no one knew what. The 1998 Internet Tax Freedom Act is a United States law authored by Representative Christopher Cox and Senator Ron Wyden and signed into law as title XI of PubL.

The House of Representatives passed HR. 105-277 enacted in 1998 implemented a three-year moratorium preventing state and local governments from taxing Internet access or imposing multiple or discriminatory taxes on electronic commerce. Effective July 1 2020 separately stated charges for internet access are no longer subject to Texas sales tax.

Internet Tax Freedom Act - Title I. 105-277 enacted in 1998 implemented a three-year. However Texas and six other states internet access taxes were grandfathered in.

Accordingly the six remaining states that tax Internet access Hawaii New Mexico Ohio South Dakota Texas and Wisconsin must by federal law stop. As of July 1 2020 those fees will be exempt. The Texas Comptrollers Office has also announced that starting July 1 2020 it is no longer imposing sales tax on separately stated internet access charges.

On June 30th 2020 the Internet Tax Freedom Acts grandfather clause will expire. In particular Ohio and Texas have imposed their sales taxes on. 644 the Trade Facilitation and Trade Enforcement Act of 2015.

This new Texas billHB. Beginning July 1 2020 Texas will no longer impose sales tax on separately stated internet access charges due to the Internet Tax Freedom Act ITFA of 2016. On February 24 2016 the President signed into law the Trade Facilitation and Trade Enforcement Act of 2015 TFTEA which permanently bans state and local jurisdictions from imposing taxes on Internet access or imposing multiple or discriminatory taxes on electronic commerce.

These states are under the grandfathered clause allowed to tax internet access because they implemented a tax prior to. Hawaii New Mexico North Dakota Ohio South Dakota Texas and Wisconsin. Hegar a test case pending in Texas.

The ten states are Hawaii New Hampshire New Mexico North Dakota Ohio South Dakota Tennessee Texas Washington Wisconsin. PITFA represents a permanent ban on taxing internet access and an elimination of the grandfathered ability to tax internet access currently allowed in seven states. The United States by way of approval by the Senate on February 11 2016 passed.

1 taxes on Internet access. Moratorium on Certain Taxes - Prohibits a State or political subdivision thereof from imposing the following taxes on Internet transactions occurring during the period beginning on October 1 1998 and ending three years after the date of enactment of this Act. But the grandfather clause has permitted such taxes if they were generally imposed and actually enforced prior to October 1 1998.

Multiple or discriminatory taxes on electronic commerce. 113th Congress a bill that would amend the Internet Tax Freedom Act to make permanent the ban on state and local taxation of Internet access and on multiple or discriminatory taxes on electronic commerce. Moratorium preventing state and local governments from taxing Internet access or imposing.

ITFA prohibits states and political subdivisions from imposing taxes on Internet access. The bill also establishes an end date of June 30 2020 for the seven states that currently impose a tax on internet access. The act made permanent a temporary moratorium on such taxes that has been in.

Meanwhile on July 15 2014 the United States House of Representatives voted to pass the Permanent Internet Tax Freedom Act HR. The states would have collected nearly 1 billion in fiscal year 2021. Senate approved a permanent extension of the Internet Tax Freedom Act that was included in HR.

Under the grandfather clause included in the Internet Tax Freedom Act Texas is currently collecting a tax on Internet access charges over 2500 per month. The exemption is mandated by the Internet Tax Freedom Act ITFA which was first enacted in 1998 to encourage growth of the fledgling internet. On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the ITFAs enactment to continue doing so will expire.

On February 11 2016 the US.

What Is The Internet Tax Freedom Act Howstuffworks

What Is The Internet Tax Freedom Act Howstuffworks

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

Fastest Mobile Networks Canada 2020 Pcmag

Texas Passes Law That Bans Kicking People Off Social Media Based On Viewpoint R Technology

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

What Is The Internet Tax Freedom Act Howstuffworks

More Us States Introduce Streaming Tax S P Global Market Intelligence

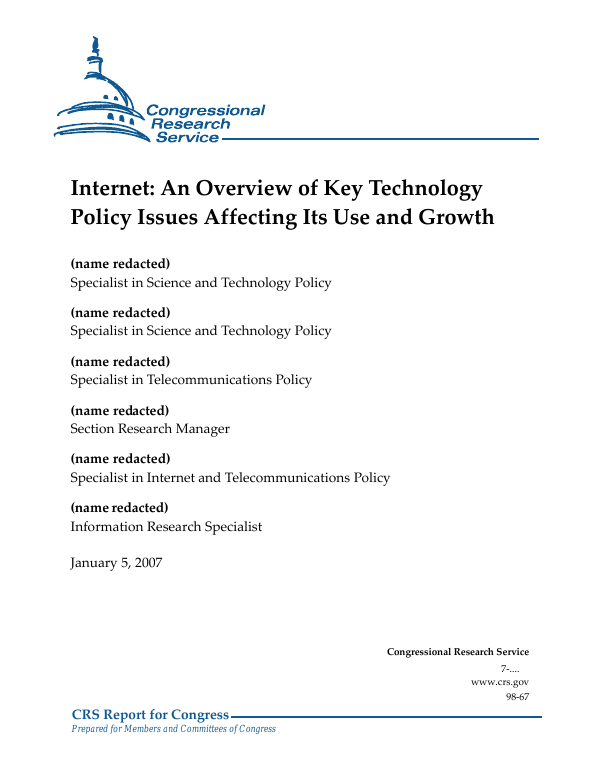

Internet An Overview Of Key Technology Policy Issues Affecting Its Use And Growth Everycrsreport Com

Samantha K Breslow Published In Tax Notes State Internet Tax Freedom Act Protector From The Tax Man

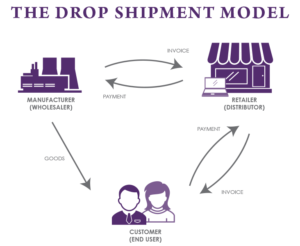

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

Texas Blockchain Legislation Status Blockchain And Cryptocurrency Regulations

George Packer The Four Americas The Atlantic

Controversial Internet Tax Freedom Act Becomes Permanent July 1

What Is The Difference Between Sales Tax And Use Tax Sales Tax Institute

Streaming And Franchise Fees Implications For Communications Infrastructure Troutman Pepper

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute